Real Estate Buyers: Don’t Make These 12 Mistakes

Introduction

Purchasing property is among the most significant financial decisions you’ll ever make. It is exhilarating, yet overwhelming and filled with expensive surprises if you’re not careful. Numerous buyers dive headfirst into the process without knowing what to steer clear of and make errors that need never have been made. From slips in the budget to missed details during inspections, these mistakes can transform your dream property into a nightmare. This post is going to take you through a dozen typical blunders property buyers tend to make so that you can feel confident and make the most intelligent purchase you can. Especially for real estate buyers, knowing the common pitfalls can help navigate the process more effectively.

Why Property Purchasers Have to Be Very Careful

Real estate buyers must be vigilant to avoid mistakes that could cost them dearly. Property buying is never a case of buying a house you like, it is a complex transaction that incorporates money, law, emotions, and time. When it comes to property buyers, a misstep can have a lasting financial impact.

The High Cost of Error

You’ll typically come as a home shopper as a novice, yet excited. Excitement, up to a point, won’t shield you from:

- Overpaying on a property

- Buy in a poor neighbourhood.

- Unforeseen repair work or legal matters

- Being stuck in a poor mortgage

These types of property mistakes are common and apparently preventable. Real estate buyers should always be aware of the potential for costly errors.

The 12 Biggest Missteps Real Estate Buyers Make

In the journey, real estate buyers should recognise the importance of informed decision-making. No two property deals are the same, but these 12 errors are among the most universal, they’re also expensive.

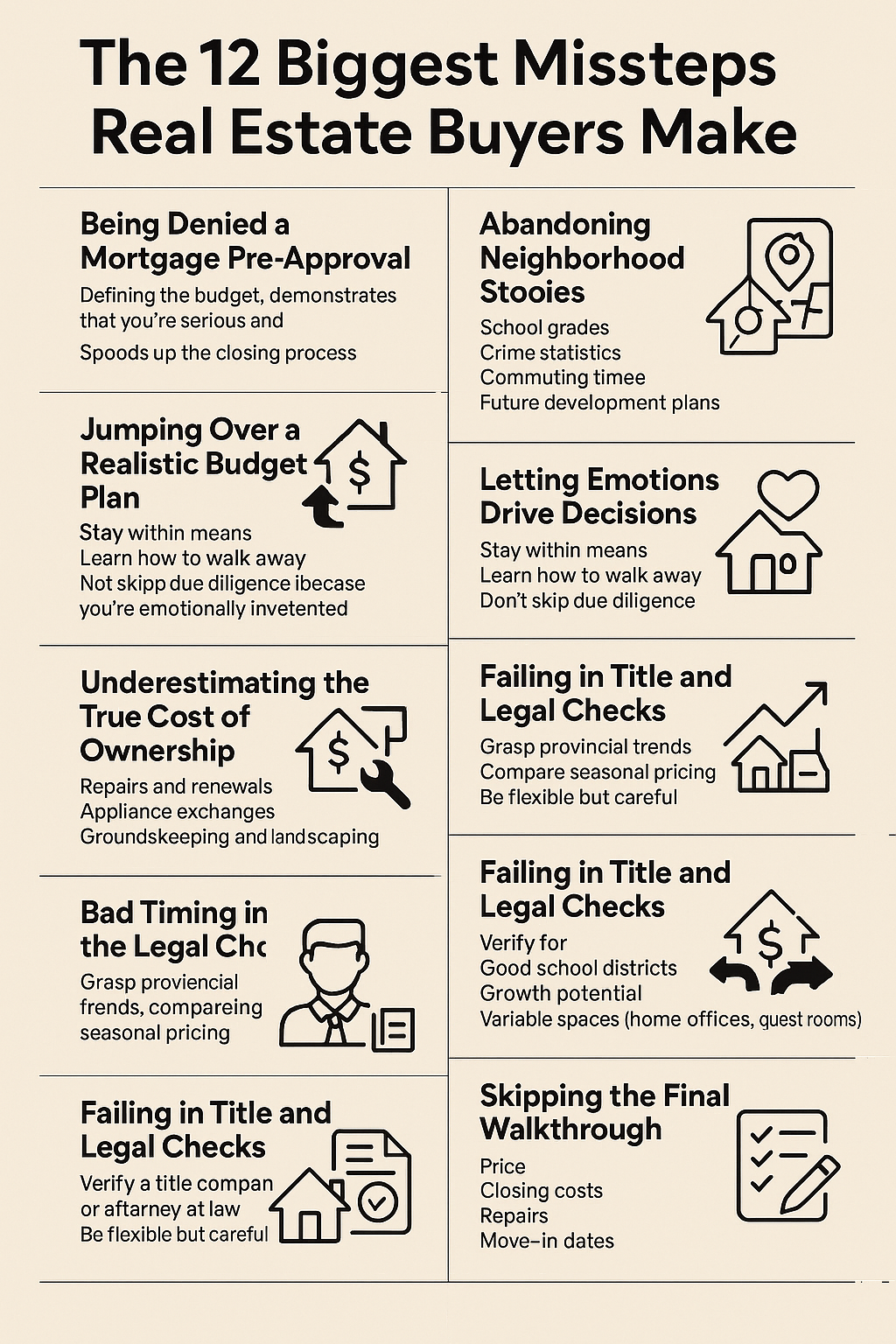

Being Denied a Mortgage Pre-Approval

Among the most critical home-buying blunders is buying without knowing how much you can afford. Becoming pre-approved:

- Categorically defines the budget

- Demonstrates that you’re serious

- Speeds up the closing process

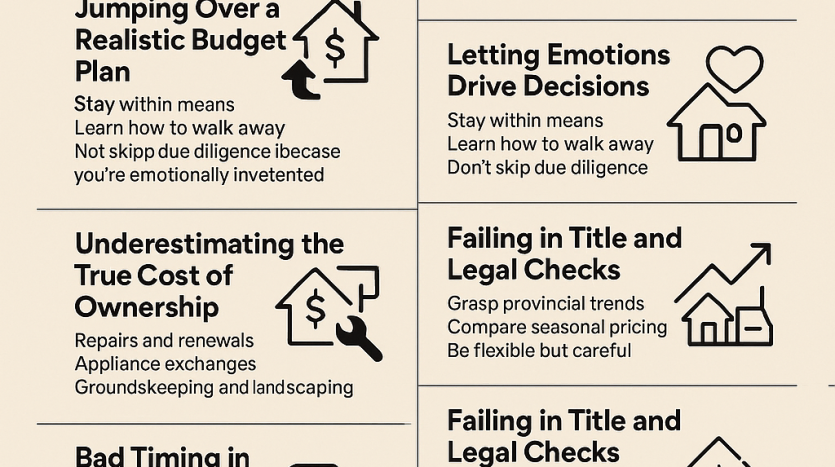

Jumping Over a Realistic Budget Plan

You could fall in love with a dream house and forget long-term affordability. In addition to your mortgage, you’ll need to be prepared to budget for:

- Property taxes

- Insurance

- Maintenance expenses

- Utilities

- HOA fees (where applicable)

Property buyers should always look ahead of the price tag.

Abandoning Neighbourhood Studies

Even the perfect home can be a living nightmare if it is in a poor area. Don’t make property mistakes by forgetting:

- School grades

- Crime statistics

- Commuting time

- Future development plans

Real estate buyers often overlook vital details during neighbourhood research.

Skipping the Home Inspection

Never skip the inspection in an attempt to speed up the transaction or make the offer more attractive. This is one of the most costly mistakes in buying a home. Real estate buyers should insist on a thorough inspection to avoid unforeseen issues.

House inspections can reveal:

- Foundation problems

- Roof damage

- Plumbing or electrical issues

- Pest infest

You’re better off leaving it than buying a “money pit.” Becoming a savvy real estate buyer means being proactive about inspections.

Letting Emotions Drive Decisions

You can fall in love with a pretty kitchen or a backyard retreat, but you can make real estate errors by making a purchase based on emotions and not logic.

- Recall

- Stay within your means.

- Learn how to walk away.

- Don’t skip due diligence because you’re emotionally invested.

Real estate buyers need to be prepared to walk away from bad deals.

Non-Compliance in Engaging a Professional Real Estate Broker

A good agent is your spokesperson, mentor, and negotiator. Acting on your own usually results in expensive mistakes.

A good agent can:

- Find listings that fit your needs

- Mark red flags

- Assistance in bargaining and forms

Property purchasers usually regret attempting to cut costs on commission fees by shunning professional assistance.

Underestimating the True Cost of Ownership

Understanding expenses is particularly important for real estate buyers.

The mortgage is just a portion of what you are paying. The first-time homebuyers tend to forget adding in:

- Repairs and renewals

- Appliance exchanges

- Groundskeepingand landscaping

- Fund priority needs

Failing to account for these expenses is among the all-time home purchase mistakes.

Bad Timing in the Market

Timing the market perfectly is nearly impossible, yet selling at the most inconvenient time, let’s say in a scorching hot sellers’ market, can be counterproductive. For real estate buyers, timing can significantly impact financial outcomes.

Real estate buyers should:

- Grasp provincial trends

- Real estate buyers should stay informed about market trends.

- Compare seasonal pricing

- Be flexible but careful.

Discuss with your broker to establish the appropriate acquisition time.

Failing in Title and Legal Checks

Failing to perform proper title checks can give rise to legal issues or possession.

Avoid these home-buying mistakes by:

- Through a title company or an attorney at law

- Real estate buyers benefit from thorough title checks to avoid future issues.

- Verify there are no liens or border conflicts.

- That possession of property is certain and legal.

Not Considering Resale Value

Even if you intend to reside there indefinitely, things have a way of turning around. Having a home with a low resale value could restrict you. Real estate buyers must consider resale value when making a purchase.

Property shoppers ought to search for:

- Good school districts

- Growth potential

- Variable spaces (i.e., home offices, guest rooms)

Skipping the Final Walkthrough

The final walk-through is your last chance to ensure everything is as intended. Don’t miss it! Final walkthroughs are critical for real estate buyers to confirm condition.

Take this chance to verify:

- That repairs were completed

- The appliances function

- Nothing was harmed or missing.

Skipping it is one of those small but impactful home-buying mistakes.

Not Negotiating Enough

Some purchasers are afraid or inexperienced in haggling. But sellers are socialized to anticipate it!

- Negot

- Real estate buyers should negotiate confidently to secure the best deal.

- Price

- Closing costs

- Repairs

- Move-in dates

Negotiate confidently and don’t overpay with the assistance of your agent.

What Savvy Real Estate Buyers Do Differently

Take a time-out and turn the focus around. We’ve examined what homebuyers should not do, now we’ll explore what savvy homebuyers do in a position to be ahead of the game. Savvy real estate buyers prepare thoroughly to avoid common mistakes.

They Prepare Before They Browse

Progressive shoppers do not begin with home tours, they begin with research and preparation. That is:

- Credit score checking and boosting if necessary

- Researching mortgage options early

- Establishing a definitive goal amount in savings toward a down payment and closing costs

Financially well-prepared real estate buyers are less likely to be disturbed by last-minute hitches. For real estate buyers, being financially prepared is crucial.

They Focus on Long-Term Value

Rather than succumbing to fashions such as ultra-smooth lines or flashy facelifts, astute purchasers seek:

- Rugged build and sturdy construction.

- Functional designs with aging potential

- Real estate buyers should prioritise long-term value over fleeting trends.

- Neighbourhoods whose value is appreciating and where infrastructure is planned

This approach prevents general property errors associated with short-term consideration.

They Build the Right Team

Purchasing real estate is a team effort. Effective purchasers are surrounded by a credible cast of characters:

- The Educated Real Estate Broker

- Trustworthy lender or a mortgage broker

- A professional home inspector

- Perhaps a property law specialist

Building a reliable team is essential for real estate buyers navigating the market.

This support system assists in recognising and dodging concealed home purchase errors along the way.

Other First-Time Real Estate Buyer Tips

First-time real estate buyers particularly benefit from additional guidance. You are most at risk of committing these errors if you are a brand-new homebuyer. These are a couple more points to give you a heads-up.

Get Educated early

Consider first-time homebuyer seminars, online tutorials, and mortgage lender counselling. Information equals less stress.

Understand Your Loan Choices

From FHA, VA, and conforming loans, there are many kinds of loans. Compare:

- Interest rates

- Down payment requirements

- PMI (Private Mortgage Insurance) regulations

- Requesting your lender to contrast and compare the pros and cons of both.

Don’t Rush the Process

Allow yourself time to:

- Explore neighbourhoods.

- Except for closing fees

- Verify contracts and disclosures.

Rushing can cause long-term real estate errors.

Create a Realistic Wishlist.

Separate your requirements and comforts:

Essentials:

- Number of bedrooms

- Safe space

- Good commute

Nice-to-Granite tops:

- Walk-in closet

- Fireplace

Being flexible can assist in making smarter choices

Prepare for Rejection

You may miss the first (or third) offer, and that is fine. Be patient, be cheerful, and be on budget. Request questions at every step. There are no dumb questions in real estate. When it comes down to closing costs or zoning laws, property buyers need never feel apprehensive about asking.

Conclusion

Real estate buyers can mitigate risks by staying informed and cautious.

Purchasing a home is a milestone event, yet it’s also a process rife with potholes. As you can attest, numerous real estate errors are a direct result of insufficient preparation, emotional choice, or dismissal of professional opinion. First-time buyer, seasoned investor, or somewhere in between, by dodging these 12 home-buying errors, you can save time, money, and heartache. Be willing to wait, be well-informed, and rely on capable professionals. With the proper approach, residential buyers can confidently traverse the marketplace and discover a home that’s a perfect fit for the long haul. Need expert guidance on your buying journey? Contact us today, and let’s make your next move a smart one.