How to find the stamp duty value of a property?

Introduction

Ever feel like buying a property comes with a million hidden costs you didn’t see coming. One of the most important, and often overlooked, fees is stamp duty. It’s more than just another line item; it’s a mandatory government charge that can significantly affect your total spending. But don’t worry, understanding how to find the stamp duty value of a property is easier than it sounds. In this blog, we’ll walk you through what it is, why it matters, and how to calculate it step by step. If you’re planning to buy property, this is something you absolutely need to know.

What is Stamp Duty?

Buying a property is exciting, but it comes with a lot of paperwork and costs. One of the most common charges you’ll encounter during the process is stamp duty. If you’re wondering what it is, how it’s calculated, or why it’s important, you’re in the right place.

This guide breaks down everything you need to know about stamp duty and stamp duty tax in a way that’s easy to understand, even if you’re not a legal or finance expert.

Stamp Duty Explained

Stamp duty is a government-imposed tax that buyers must pay when purchasing certain types of assets, most commonly real estate or property. It is essentially a legal tax on documents, especially those involved in the transfer of property ownership.

Why is it called “stamp” duty?

The name originates from the practice of stamping documents as proof that the tax has been paid. Once the stamp is affixed, the document becomes legally valid in the eyes of the law.

What Does Stamp Duty Tax Apply To?

While stamp duty tax is most commonly associated with buying residential property, it can also apply to:

- Commercial property transactions

- Land purchases

- Lease agreements

- Gift deeds and inheritance of property

- Some types of financial securities or shares

Note: The rules and applicability may vary by country or state, so it’s essential to check local laws.

Why Is Stamp Duty Important?

Paying stamp duty isn’t just a formality, it’s a legal requirement. Without paying this tax, the property transfer is not considered legally binding, which can lead to complications down the line.

Here’s why it matters:

- Legal Validation: It gives your property documents legal validity.

- Proof of Ownership: It ensures your name is officially registered as the owner.

- Avoid Penalties: Failing to pay the correct stamp duty tax on time can result in heavy fines or delays in registration.

Who Pays Stamp Duty?

Typically, the buyer pays the stamp duty, not the seller. However, this can sometimes be negotiated as part of the property sale agreement, especially in markets with flexible practices.

Tip: Always clarify this with your seller or real estate agent before signing any agreements.

How Is Stamp Duty Calculated?

The stamp duty value is not a flat rate, it depends on several factors:

Property Value

The higher the property’s market or agreement value, the more stamp duty you’ll pay.

Location

Different states or regions have different stamp duty tax rates. For instance:

- In some Indian states, women buyers get discounted rates.

- In the UK, the rates change depending on the property price band.

Property Type

Residential properties may have lower rates than commercial ones. Also, new and resale properties may be taxed differently.

Buyer’s Category

Special rates may apply to:

- First-time homebuyers

- Senior citizens

- Female buyers

Example: If your state charges 5% stamp duty on a ₹50 lakh property, you’ll pay ₹2.5 lakhs as stamp duty tax.

How and When Do You Pay Stamp Duty?

You usually pay stamp duty at the time of property registration. Here’s how:

Modes of Payment:

- Online through government portals

- Offline at sub-registrar offices

- Through authorised banks

Timing:

- In most places, stamp duty must be paid before or at the time of signing the sale deed. Delays can attract penalties.

Always ensure you receive a stamp duty receipt, as it’s required for legal and tax purposes.

Is Stamp Duty Tax Deductible?

In some countries, yes, but only under certain conditions.

For example:

- In India, under Section 80C of the Income Tax Act, stamp duty tax can be claimed as a deduction (up to a limit), but only for residential properties and in the year the expense is incurred.

- In other countries, it may not be deductible at all.

Check with a local tax advisor or CA for specific guidance based on your location.

Common Myths About Stamp Duty

Let’s clear up some misunderstandings:

- “It’s optional.” – No, it’s legally mandatory.

- “Only rich people pay it.” – Everyone buying property pays stamp duty, regardless of value.

- “It’s the same everywhere.” – Rates and rules vary by region and buyer category.

Why Is It Important to Know the Stamp Duty Value?

When you’re buying a property, there’s a lot to think about, finding the right location, securing financing, dealing with paperwork, and more. But there’s one often-overlooked cost that can significantly impact your budget, Stamp Duty.

Understanding the stamp duty value before you commit to a property deal is not just helpful, it’s essential. In this blog, we’ll explain why knowing the stamp duty amount in advance can save you money, prevent legal trouble, and help you plan smarter.

Why Stamp Duty Value Shouldn’t Be Ignored

Let’s dive into why it’s so important to calculate and understand the stamp duty before buying a property.

Helps with Accurate Budget Planning

Most buyers focus on the property price, forgetting about additional charges like registration fees, brokerage, and stamp duty tax. But stamp duty can run into thousands, or even lakhs, depending on your property’s value.

Why this matters:

- It affects your total purchase cost.

- You may need to borrow more or allocate extra savings.

- Ignoring it can cause last-minute financial stress.

Tip: Always include stamp duty in your upfront budget estimates.

Avoids Legal Issues and Delays

Stamp duty isn’t optional, it’s a legal requirement. Without paying the correct stamp duty, your property documents won’t be considered valid in the eyes of the law.

Risks of non-payment or underpayment:

- Delay in registration

- Penalties and fines

- Possible invalidation of the sale deed

When you know the correct stamp duty value, you can ensure timely payment and proper documentation, avoiding these legal headaches.

Makes You Eligible for Tax Benefits (In Some Cases)

In certain countries, including India, stamp duty tax paid on a residential property may qualify for income tax deductions under specific sections like 80C.

However:

- These deductions apply only under certain conditions.

- You must retain proof of stamp duty payment.

Knowing how much you’re paying in stamp duty helps you keep accurate tax records and claim benefits where allowed.

Avoids Overpayment

Without proper knowledge, you might rely solely on agents or third parties who may not always quote the correct rate.

By knowing the actual stamp duty value:

- You avoid being overcharged.

- You can verify rates on government portals.

- You have better control over your finances.

Pro Tip: Use official online stamp duty calculators to get accurate, up-to-date figures based on your location and property type.

Impacts Property Transfer Timing and Strategy

In high-value transactions, the stamp duty amount may influence when and how the transfer takes place.

For instance:

- You might decide to register the property jointly to reduce duty.

- Some states offer concessions to women or first-time buyers.

- Government policies may change, but timing your purchase well can save you money.

Being aware of these factors means you can plan strategically to minimise your stamp duty tax liability.

Improves Transparency in the Buying Process

Knowing the exact stamp duty value keeps the entire property transaction transparent. It empowers buyers to:

- Ask the right questions.

- Verify documentation

- Negotiate more effectively

In short, it puts you in control, not just relying on agents or developers.

How to Find Out the Stamp Duty Value?

It’s easier than you might think. You can find accurate stamp duty amounts using:

- Government property registration websites

- Official stamp duty calculators

- Local sub-registrar offices

- Legal advisors or property consultants

You’ll need:

- Property value (market/circle rate)

- Location (state/city)

- Type of property (residential, commercial)

- Buyer’s profile (individual, woman, first-time buyer, etc.)

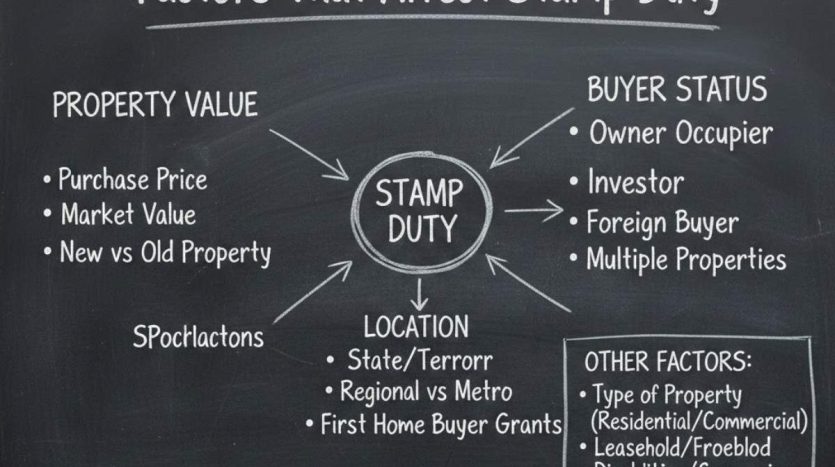

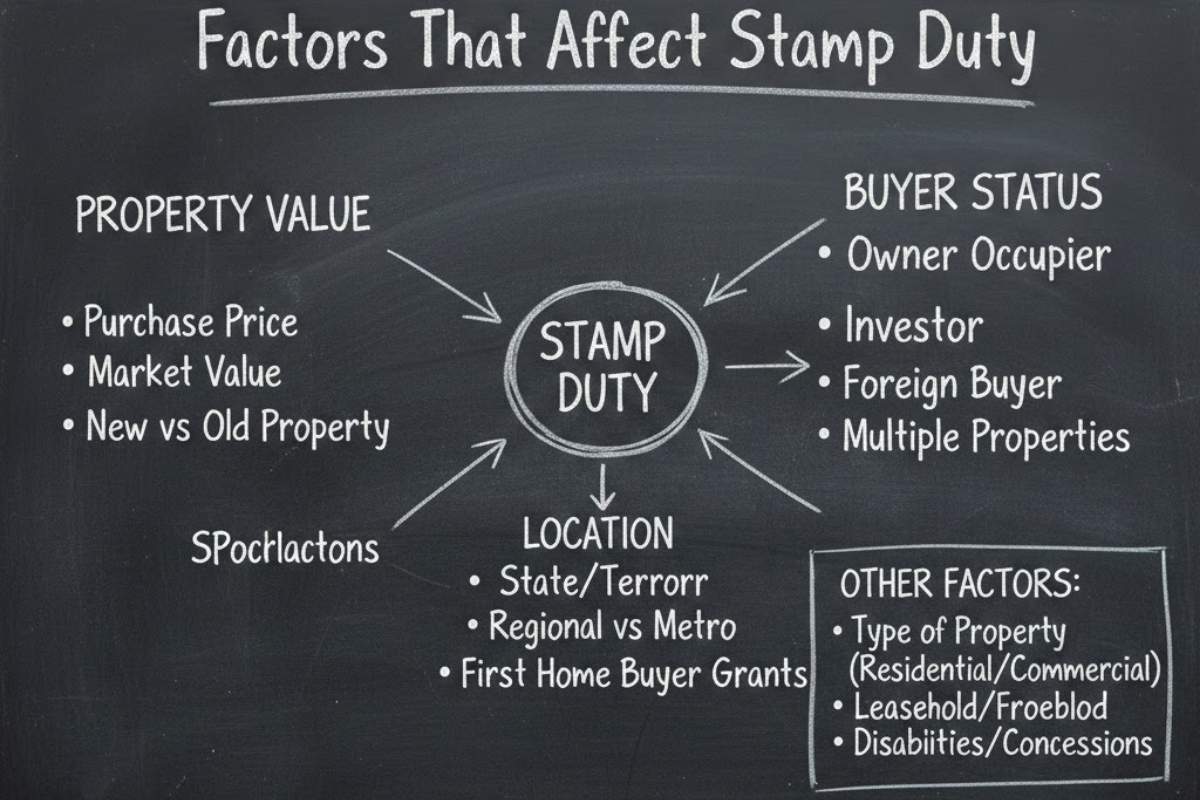

Factors That Affect Stamp Duty

But don’t overlook the stamp duty, a mandatory fee that can add a significant chunk to your total cost. Whether you’re a first-time buyer or a seasoned investor, understanding the factors that affect stamp duty helps you plan your finances better and avoid surprises during the registration process.

Let’s explore what influences stamp duty tax, so you can make informed decisions and stay in control of your property transaction.

Understanding Stamp Duty

Before diving into the factors, let’s quickly cover what stamp duty actually is.

Stamp duty is a government-imposed tax paid by the buyer when a property is transferred or sold. It gives legal validity to the transaction and is required for property registration. This tax, often referred to as stamp duty tax is calculated as a percentage of the property’s value and must be paid at the time of registration.

Essential Factors That Impact Stamp Duty

The stamp duty amount isn’t fixed. It varies based on several factors related to the property and the buyer. Below are the major elements that determine how much stamp duty you’ll pay.

Property Value

This is the biggest factor. Stamp duty tax is calculated as a percentage of the property’s value, so the higher the property cost, the more you’ll pay.

- Stamp duty is often calculated on market value or circle rate (whichever is higher).

- For high-value properties, even a 1-2% difference can amount to a big sum.

Tip: Always check both market and guideline values to get an accurate estimate of stamp duty.

Location of the Property

Where the property is located plays a major role in determining stamp duty rates.

- Different states or regions have different stamp duty slabs.

- Urban areas usually attract higher rates than rural locations.

- Some states offer concessions for certain areas or development zones.

For example, stamp duty in Maharashtra may differ between Mumbai and a tier-2 city like Nagpur.

Type of Property

Stamp duty also varies depending on whether the property is:

- Residential or commercial

- Leasehold or freehold

- New construction or resale

- Commercial properties often have higher stamp duty rates than residential ones due to their business potential and zoning.

Did you know? Stamp duty on a new flat may also include charges on amenities like parking, clubhouse access, and more, depending on your jurisdiction.

Ownership Type and Buyer’s Category

The buyer’s profile can influence stamp duty tax rates. Some governments offer discounted rates to encourage certain demographics.

- Common exemptions or rebates:

- Women buyers may get reduced rates in many Indian states.

- First-time buyers sometimes receive concessions.

- Senior citizens or armed forces personnel may qualify for benefits in select regions.

Always check whether your buyer category qualifies for any rebate before making the purchase.

Usage of the Property

Is the property being bought for self-use or investment? That too can impact the applicable stamp duty in some regions.

- Properties bought for rental or business use may have higher stamp duty.

- Owner-occupied homes sometimes qualify for slightly lower rates.

This factor might not apply everywhere, but it’s worth confirming with local authorities or your legal advisor.

Mode of Transfer

Stamp duty doesn’t only apply to purchases. It is also charged on other types of transfers, like:

- Gift deeds

- Inheritance

- Exchange of properties

Each type of transfer may attract different stamp duty tax rates. For example, transferring property as a gift between blood relatives might qualify for a lower duty or even exemption in some cases.

Government Policy Changes

Stamp duty is governed by state or regional laws, which means rates can change based on government policies.

- During economic slowdowns, governments may temporarily reduce stamp duty rates to boost real estate activity.

- New policies or budget announcements can lead to changes in rates overnight.

Pro Tip: Keep an eye on government notifications and plan your property registration accordingly to take advantage of any available discounts.

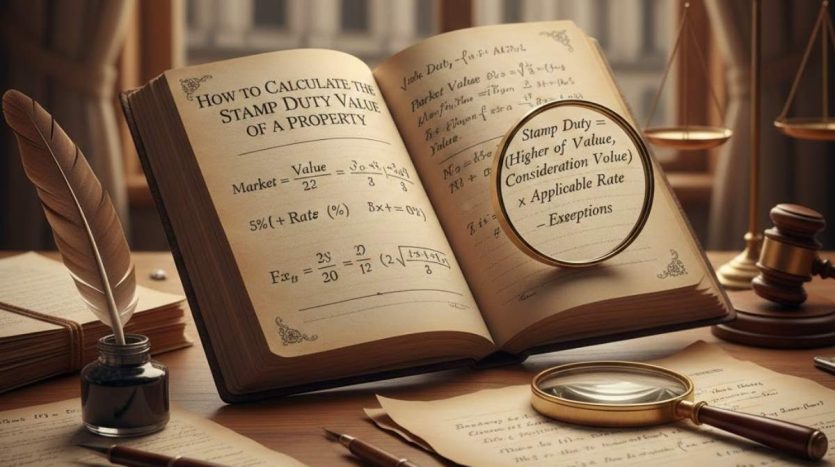

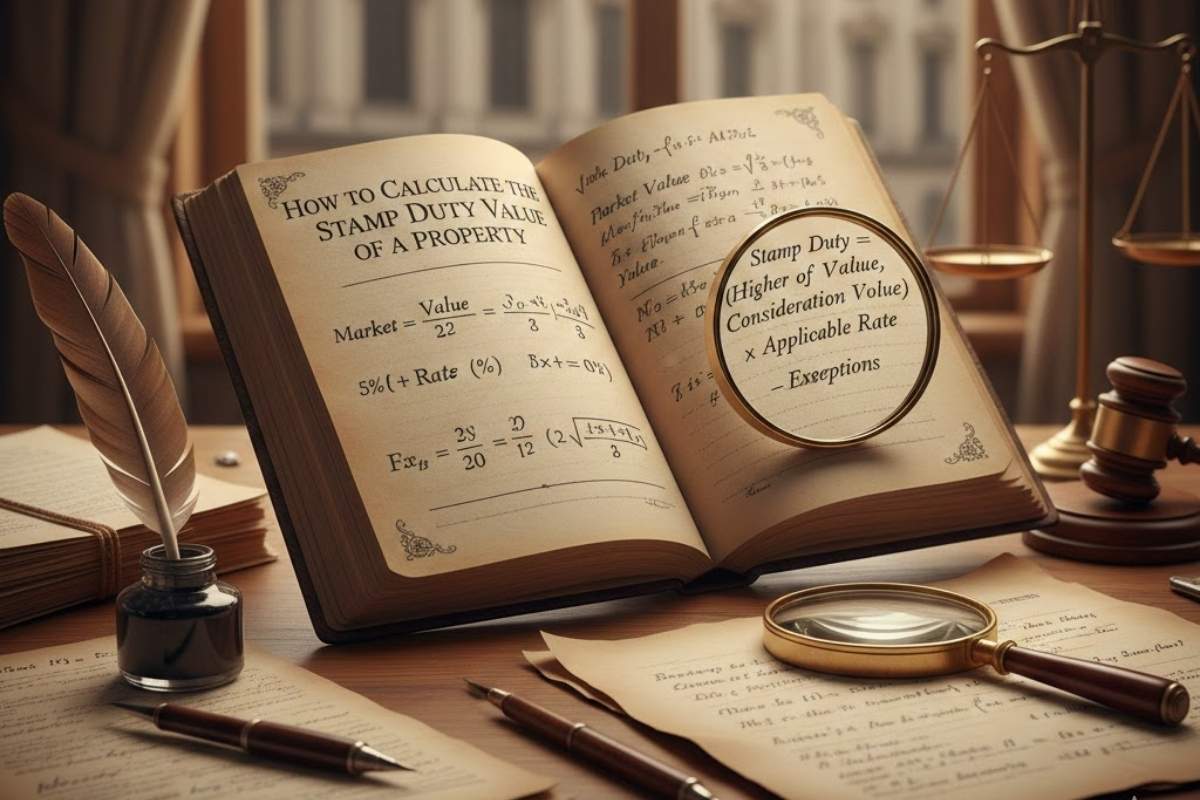

How to Calculate the Stamp Duty Value of a Property

Buying a property is one of the biggest financial decisions you’ll ever make. From choosing the right location to finalising the price, every detail matters. But there’s one cost many buyers forget to budget for: stamp duty.

Stamp duty is a government levy paid by the buyer to legally register a property. And unlike broker fees or legal charges, stamp duty tax is not optional, it’s a mandatory expense that can significantly increase your overall cost.

In this blog, we’ll walk you through how to calculate the stamp duty value of a property, step-by-step, so you’re never caught off guard during a transaction.

Basics of Stamp Duty

Stamp duty is a type of tax imposed by the government on legal documents, especially property transfer documents. It validates the purchase legally and makes the property registration official. This is why it’s often referred to as stamp duty tax in many regions.

The exact amount you pay depends on several factors, such as property value, location, buyer category, and current tax laws in your area.

Why It’s Important to Calculate Stamp Duty in Advance

Knowing the stamp duty value beforehand helps you:

- Plan your budget accurately.

- Avoid last-minute surprises

- Ensure smooth property registration.

- Stay legally compliant

Let’s now break down the steps to help you calculate it yourself.

Know the Property Value

The first thing you’ll need is the property’s market value or the circle rate (also called the guidance value), whichever is higher.

- Market value: The price at which the property is being sold.

- Circle rate: The minimum rate set by the local authority for property transactions in a particular area.

Stamp duty is calculated on the higher of these two values.

Example:

If your market price is ₹75 lakhs but the circle rate value is ₹80 lakhs, stamp duty will be calculated on ₹80 lakhs.

Check Your State’s Stamp Duty Rate

Stamp duty tax rates differ across states and regions, and they may also vary depending on the type of property and buyer category.

Here are some examples (for illustrative purposes only):

- Maharashtra: 5% for urban areas, 6% for commercial properties

- Delhi: 4% for women, 6% for men

- Karnataka: 3%-5% depending on the value slab

Always check your state government or municipal website for the most updated rates.

Consider the Buyer Category

In many states, the stamp duty tax is lower for:

- Women buyers

- Senior citizens

- First-time home buyers

- Joint ownership (especially when one party is female)

These concessions can save you a substantial amount, so don’t forget to factor them in.

Include Surcharges or Additional Cess (If Any)

Some regions add extra charges on top of the base stamp duty:

- Metro development cess

- Local body tax

- Municipality or panchayat charges

These might add 1–2% to your total tax bill, so it’s important to include them in your calculation.

Do the Math (Manual or Online)

Now you’re ready to calculate the stamp duty value:

Manual Formula:

Stamp Duty = Applicable Rate (%) × Property Value (Circle or Market Rate, whichever is higher)

Or use an Online Calculator:

Many government and private portals offer free stamp duty calculators. You’ll just need to enter:

- Property value

- State or region

- Buyer category (e.g., female, senior citizen)

- Property type (residential or commercial)

Pro Tip: Use official sources like your local registration department’s website to ensure accurate results.

Add Registration Charges

While calculating stamp duty, don’t forget the registration fee, which is often around 1% of the property value. This is separate from stamp duty but must be paid at the same time.

Example Breakdown:

Let’s say:

- Property value = ₹80,00,000

- Stamp duty rate = 5%

- Registration charges = 1%

- Stamp Duty Tax = ₹80,00,000 × 5% = ₹4,00,000

- Registration Fee = ₹80,00,000 × 1% = ₹80,000

- Total Payable = ₹4,80,000

That’s nearly ₹5 lakhs extra, so planning is essential!

Make the Payment

Once you’ve calculated the total, you can pay stamp duty either online or offline, depending on your local rules.

Common Payment Methods:

- Online government portals

- Authorized banks

- Stamp papers or e-stamping services

- At the sub-registrar’s office

Always keep a receipt of payment, as it will be needed during the registration process and for future reference.

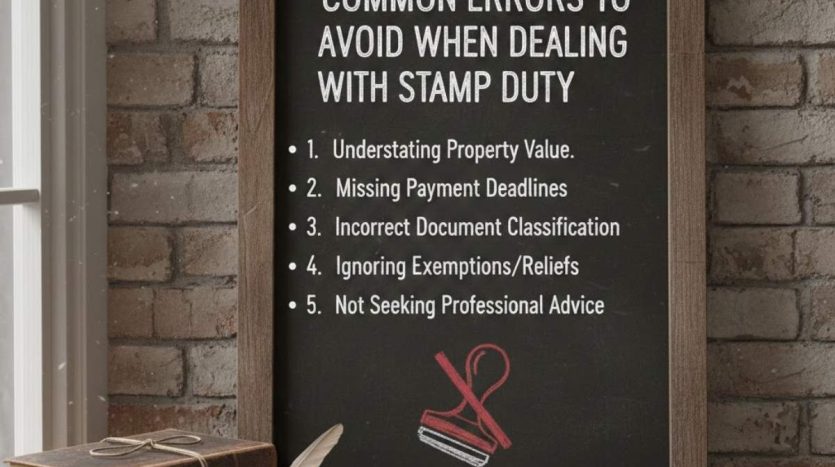

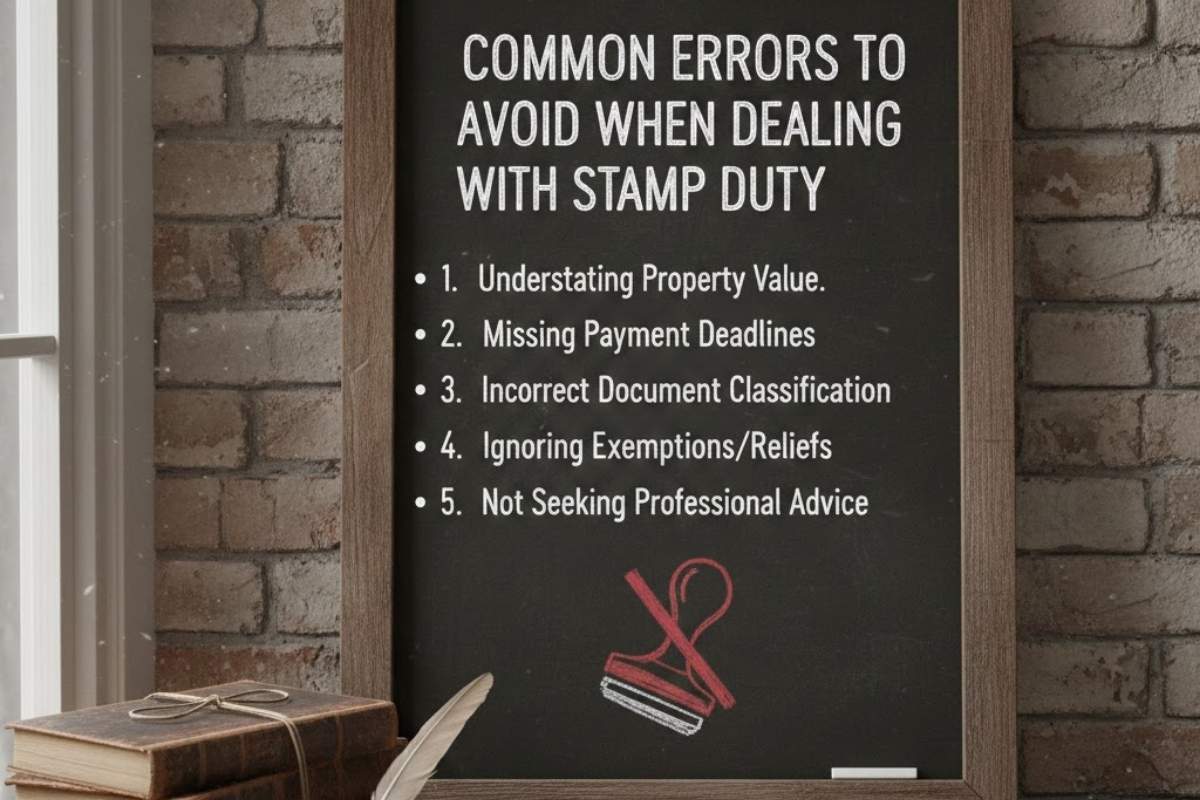

Common Errors to Avoid When Dealing with Stamp Duty

If you’re planning to buy a property, you’re likely focused on big things like location, budget, and the right deal. But there’s one important cost many buyers overlook until the last minute, Stamp Duty.

Stamp Duty is a mandatory fee imposed by the government when property ownership is transferred. It legally validates your transaction and is often referred to as Stamp Duty tax in official documents.

While calculating or paying stamp duty may seem straightforward, many people make mistakes that can lead to legal trouble, financial loss, or delays in registration. In this blog, we’ll walk you through the most common errors to avoid when dealing with stamp duty so you can complete your property purchase smoothly and confidently.

Underestimating Stamp Duty Costs

Many buyers forget to account for stamp duty when calculating their overall property budget. Since stamp duty tax can be a significant amount, often 4% to 7% of the property’s value, it shouldn’t be treated as an afterthought.

Avoid this by:

- Including stamp duty in your total purchase budget.

- Use a stamp duty calculator based on your state and property type.

- Considering additional charges like registration fees and surcharges.

Tip: Stamp duty is calculated on the higher of market value or government-assessed circle rate, so don’t rely solely on the selling price.

Using Outdated Stamp Duty Rates

Stamp duty rates are governed by state or regional authorities and can change over time. Relying on outdated information from friends or property agents may result in incorrect calculations.

What you should do:

- Visit your local government or land registration portal for the latest rates.

- Check for any recent budget changes or tax notifications.

- Confirm applicable rates based on your buyer category (e.g., woman, senior citizen, first-time buyer).

Remember: Stamp Duty tax benefits or exemptions are sometimes available only temporarily.

Ignoring Buyer-Based Concessions

Many states offer stamp duty concessions for specific buyer groups, like:

- Women property buyers

- Senior citizens

- Joint owners (especially husband-wife purchases)

- First-time homebuyers

Failing to apply for these benefits is a missed opportunity to save money.

- To avoid this mistake:

- Check if you qualify for any rebates.

- Make sure the property is registered in the name of the eligible buyer.

- Submit the required documents at the time of registration.

Not Verifying Property Details Properly

Stamp duty is calculated based on the property’s characteristics, its type, usage, and location. If any of these details are entered incorrectly, it could result in an overpayment or underpayment of stamp duty.

Key areas to double-check:

- Type of property (residential vs. commercial)

- Freehold or leasehold status

- Location and municipal jurisdiction

- Intended use (self-occupied vs. rental/investment)

An incorrect classification may cause problems during property registration.

Relying Only on Agents for Stamp Duty Calculation

While property agents are helpful, they are not always up-to-date with the latest stamp duty tax regulations. Blindly trusting their numbers can lead to errors.

What to do instead:

- Use official government calculators for accurate estimates.

- Cross-check rates from multiple sources.

- Speak to a legal or financial advisor if you’re unsure.

Delaying Stamp Duty Payment

Stamp duty must be paid before or at the time of registration. Delays can lead to:

- Penalties and late fees

- Legal disputes

- Cancellation or rejection of the sale deed registration

Avoid this by:

- Planning your payment timeline in advance

- Keeping funds ready on the day of registration

- Ensuring all documents are prepared for a smooth transaction

In some regions, delayed payment may attract interest at a daily rate.

Forgetting to Keep Proof of Payment

Paying the correct stamp duty is not enough, you must keep a valid receipt or certificate as proof of payment.

Without it, you may face:

- Legal challenges during resale

- Issues while applying for home loans

- Complications in property mutation or inheritance

Best practices:

- Use government-authorised channels to make payments.

- Request an e-stamp or official receipt immediately after payment.

- Store the documents both physically and digitally.

Confusing Stamp Duty with Registration Charges

Many buyers think stamp duty tax and registration fees are the same. They are not.

- Stamp Duty: Tax paid to legally validate the transfer of ownership.

- Registration Fee: Charged for recording the property in the government’s official records.

Typically, registration fees are around 1% of the property value, and they are payable in addition to stamp duty.

Conclusion

Understanding stamp duty and avoiding common mistakes can save you from unnecessary expenses, legal issues, and last-minute surprises during a property transaction. From budgeting accurately and using updated stamp duty tax rates to checking for buyer concessions and ensuring timely payment, each step matters. Knowing how to calculate the correct amount, verifying property details, and keeping proof of payment ensures a smooth and stress-free buying experience. Whether you’re a first-time buyer or a seasoned investor, being informed and prepared empowers you to make confident decisions and protects your investment. Plan, because smart property purchases start with smart planning. If you have questions about stamp duty, need help calculating your stamp duty tax, or want expert guidance for your property transaction, feel free to contact us. We’re here to help you make informed and confident decisions every step of the way.

Frequently Asked Questions

Q1. What is the current stamp duty rate in [insert location]?

Ans. Stamp duty rates vary by state, property type, and buyer profile. For accurate rates in [insert location], check your local government’s official portal.

Q2. Is stamp duty the same as registration charges?

Ans. No. Stamp duty is a government tax on property transactions, while registration charges are a separate fee to record ownership in official records.

Q3. Can stamp duty be paid in instalments?

Ans. Generally, stamp duty tax must be paid in full before or at the time of registration. Instalments are not allowed, though some home loan options may include them.