Global Luxury Real Estate: Top Emerging Trends Today

Introduction

The international luxury residential property market is shifting at an extremely accelerated rate, propelled by increasing investment by high-net-worth individuals. Trendy, design-focused homes and high-end villas have never been more sought after. Large-scale global trends such as green development and high-technology living are reshaping luxury residential property. They are not only the benchmark in luxury but also driving long-term investment decisions. It is crucial that the investors, developers, and buyers are aware of such trends so that they stay in the know. Awareness about the trend of the market guides them in making informed decisions and staying in the game in this fast-changing, dynamic luxury real estate market.

The Increasing Demand for Luxury Real Estate

The luxury residential market is moving upscale with high-net-worth individuals looking for standalone homes that provide convenience, anonymity, and luxury facilities. Affluence expansion globally, urbanization, and expectations of quality of life fuel demand through a trend. Optimal locations, intelligent technology, and green options also drive luxury property upward globally.

What’s Fueling the Global Boom in Luxury Real Estate?

- World Wealth Growth and Its Impact: With wealth rising across the globe, more investors are flowing into the market of luxury real property. Foreign investors are searching for safe-haven investments at an exponential rate, leading to mounting demand for luxury houses in developed and developing countries.

- Lifestyle-Driven Transactions: The wealthier buyers today are focusing more on lifestyle benefits than on traditional location factors. Intelligent design, health-focused amenities, and sustainable lifestyles are influencing luxury residence design, buying, and appraising.

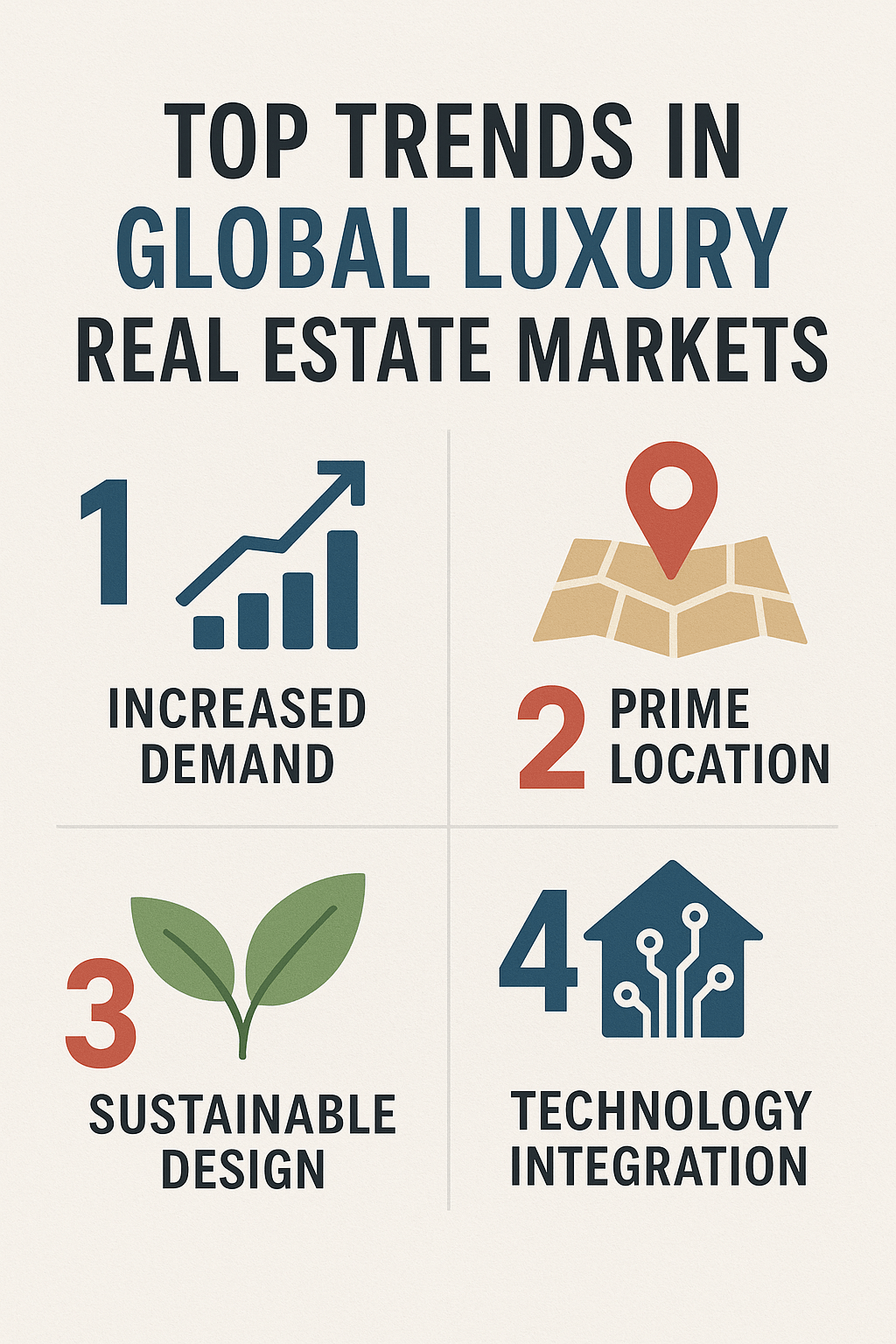

Key Worldwide Luxury Real Estate Trends

Offshore luxury real property is evolving with enormous demand for high-end residential real property in city and resort markets. Exclusivity, sustainability, and home technology are most important to purchasers. Luxury buyers want homes with lifestyle, security, and ultimate value. Cross-border buying and second-home investing are growing, characterizing an aggressive, technology-based luxury market everywhere.

Global Shifts in Luxury Real Estate and Buyer Behavior

- Sustainability and Eco-Luxury: Green building is no longer a trend, now it’s the norm. Consumers are attracted to eco-friendly luxury homes with green features, renewable energy systems, and sustainable materials. Eco-luxury is not a nicety, it’s a value decision for the property.

- Tech-Integrated Luxury Homes: Technology keeps evolving the luxury residential lifestyle. From advanced security systems to automatically functioning smart homes, contemporary luxury homes are conceived with simplicity of living, security, and a modern lifestyle in mind. Virtual reality home tours and blockchain payments are now also transforming the high-end property purchasing and sale process.

- Prime Urban Luxury Real Estate Hotspots: Global cities such as New York, London, Dubai, and Hong Kong remain at the forefront of luxury homes. Such cities boast cultural diversity coupled with return on investment, which renders them sustainable bases for luxury house development.

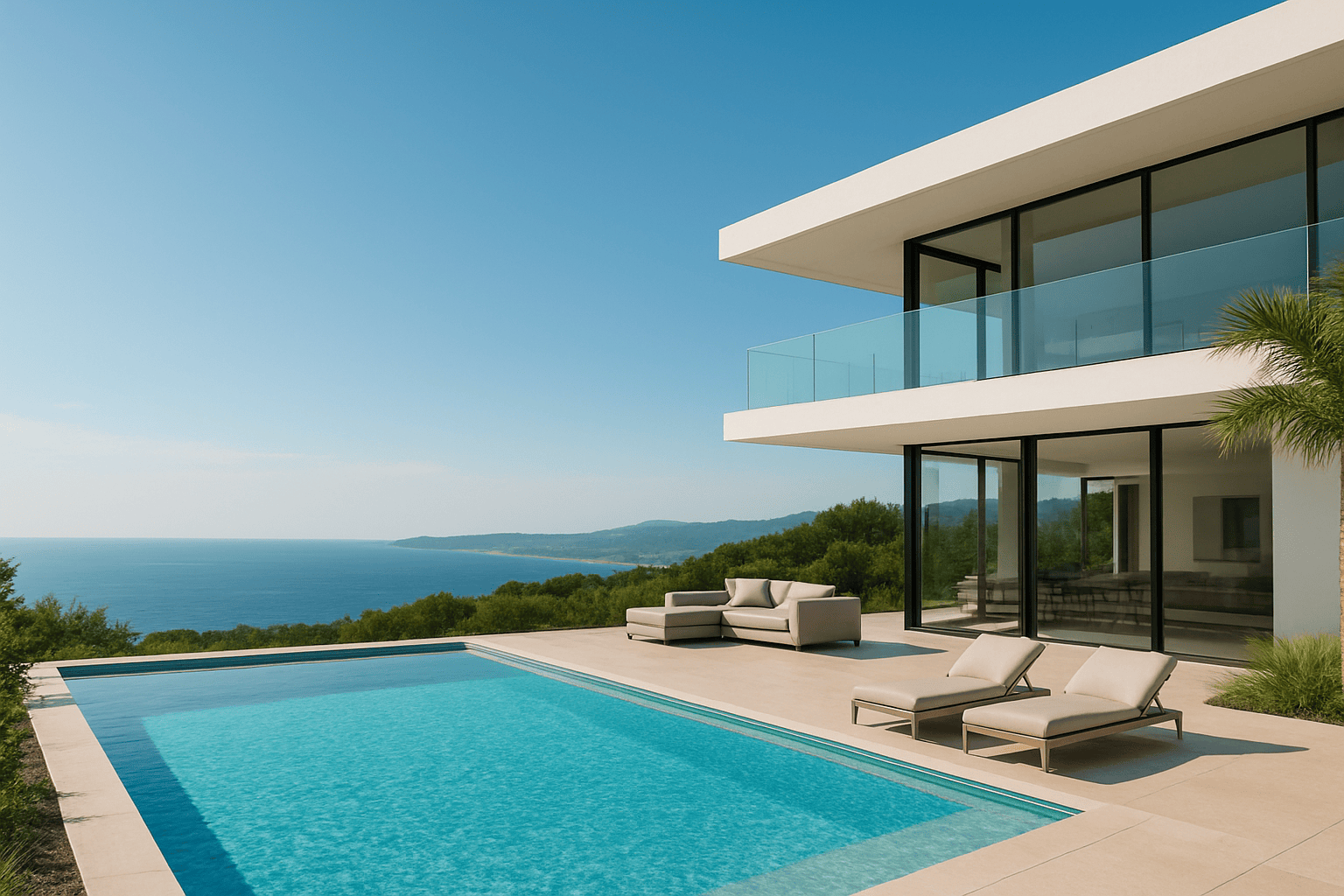

- The Emergence of Exquisite Retreats: Beyond cities, there is a greater demand for private homes in secluded, isolated locations. Beach houses, mountain retreats, and private islands are coveted by the luxury crowd because they want the seclusion and peace of mind for their lifetime in a city.

Regional Insights into Luxury Property

Luxury residential markets differ widely across regions regarding lifestyle, infrastructure, and local economies. Beachside areas are highly sought after for holiday homes, while central business districts attract buyers seeking prestige and convenience. Regional differences drive prices, investment strategies, and possible expansion opportunities in the global luxury residential market.

Trends and Highlights in Global Luxury Property Markets

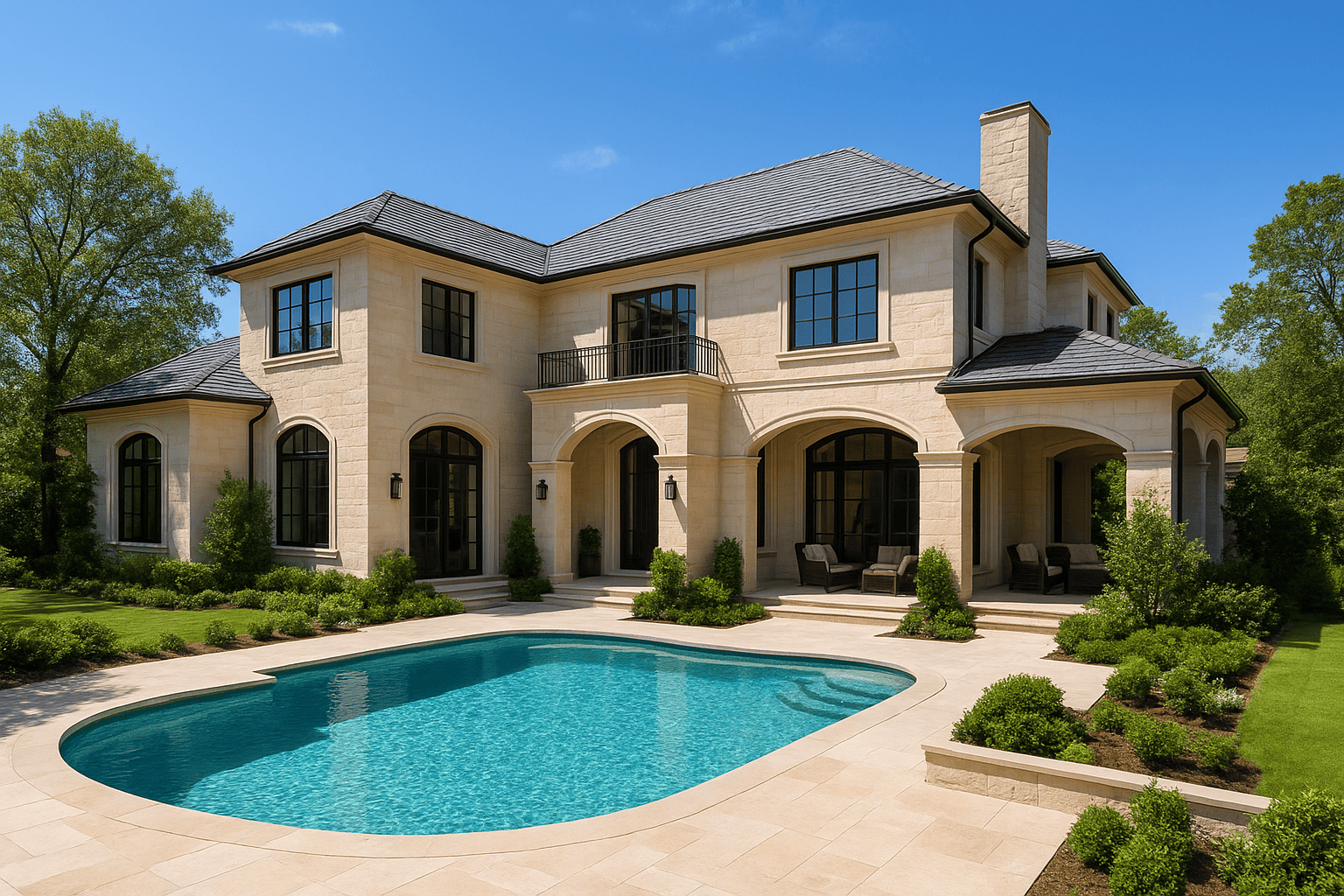

- North America: The United States and Canada continue to dominate the luxury property market. Manhattan penthouse apartments and Beverly Hills mansions continue to stand as the acme of safety and wealth. Second homes in beaches and ski resorts are increasingly in demand.

- Europe: Europe’s luxury residences combine traditional heritage with modern allure. An Italian vintage villa, a château in France, or a townhouse in London is Europe’s luxury residence built on the pillars of its design and cultural heritage.

- Middle East & Asia: Dubai is the world’s fastest-growing luxury residential real estate market, boasting state-of-the-art design, tax-efficient regulations, and unparalleled amenities. Asia’s rising wealth community, however, is fueling demand for contemporary luxury flats in Singapore, Hong Kong, and Bangkok.

Investment Opportunities in High-End Property

Investment in luxury property has long-term high-growth and high-return opportunities. Luxury property is of interest to high-net-worth individuals for exclusivity, privileged location, and high-end amenities. These properties will retain or appreciate value even in a market slowdown. With growing international demand, investment in high-end property is an asset class that is a portfolio diversifier and a high performer.

Profitable Avenues in Global High-End Real Estate Today

- Long-Term Value and ROI: Luxury homes are always solid investments, yielding value over the long term regardless of the state of the economy. Rental yields on luxury properties in prime markets account for their appeal as an asset class.

- Emerging Markets to Watch: While global cities remain the pre-eminent magnets, secondary cities and new luxury cities present exciting prospects. Investors with high growth potential are focusing on emerging markets that provide affordability and new luxury real estate development.

Challenges Facing the Global Luxury Real Estate Market

The global luxury real estate market is on the rise, but is confronted with a range of advanced dilemmas. Volatility of the international economy and unsteady international markets may moderate the level of consumer confidence, along with investment levels. Changing regulations for foreign buyers, e.g., taxation regulations and ownership restrictions, create financial as well as legal complications. Surplus in niche markets dilutes exclusivity and forces developers to compete on a platform of uniqueness with innovation, green properties, and cutting-edge high-tech technology.

Economic, Political, and Consumer Shifts in Luxury Realty

- Economic Uncertainty: The sluggish global economy, volatile exchange rates, and rising inflation diminish the purchasing power of wealthy individuals. The resultant economic squeeze lowers their propensity to spend and confidence levels, and sets a ripple effect that brings down overall investor sentiment. With deepening economic uncertainty, luxury brands and overall investment alike develop heightened caution, a sign of a conservative strategy across financial circles and wealth management strategies.

- Regulatory Barriers: Policy tax uncertainty, external controls on ownership, and stringent residence requirements would deter foreign buyers, say, and deter cross-border acquisition of property. These regulatory barriers are undermining international investors, reducing the market openness and facilitation of investment flow. Eliminating these barriers is key to making space as open and accessible as it can be to cross-border property transactions and the facilitation of foreign players in property markets.

- Oversupply vs. Exclusivity: Surplus supply of luxury houses in the market takes away their uniqueness and charm, depreciating the scarcity so crucial to high-net-worth consumers. Luxury, being the new standard, loses the exclusivity that otherwise characterized it among high-net-worth investors. Saturation eliminates the VIP position of these houses thus far, diluting their market dominance and long-term value to high-end residents.

- Buyers’ Choices Change: Green building codes, smart appliances, green designs, and luxury elements are now on everyone’s mind of the homeowner today. These evolving requirements always compel contractors to be wiser than each other and deliver innovative solutions meeting the demands of sustainability, yet comfortable and elegant. As the expectations expand, so will the construction industry, and it will also have to evolve, innovating more to meet nature-centric and quality-demanding customers.

- Cultural Orientations: Transborder consumers and builders of culture-sensitivity must turn architectural, interior, and facility design into something tailored to culture sensitivity and evolving lifestyles. Structured familiarity with dissimilar cultural values and responsive design from them will peak user experience and usability. Intelligent customization is the basis of inclusivity, comfort, and expression of identity beyond borders, creating destinations significant, interactive, and adaptive to cultural differences in a time of globalization.

- Cost Volatility: Volatility of labor and land costs, high material expenses, and shifting government policies affect a project primarily from the aspect of profitability. These risky factors introduce financial uncertainty into returns, making it challenging to forecast. Proactive risk management, planning for contingencies, and following regulations through changes are crucial to maintaining profitability as well as ensuring the long-term sustainability of any development project.

- Currency & Geo-Political Risk: Cross-border luxury real estate investment is susceptible to such sources of risk as political unrest, trade wars, and unstable exchange rates. These cause uncertainty in the market, cause cross-border transactions to be difficult, and impact levels of investor confidence. Currency volatility affects returns, political turmoil and economic tensions introduce uncertainty, and all such factors are best solved through strategic planning, risk management, and extensive market awareness in trying to acquire investments and become long-term profitable.

Conclusion

The global luxury residential market is at the threshold of a new era marked by sustainability, innovation, and lifestyle-driven design. Whether it is piercing skyscrapers in bustling city centers or secluded estates with anonymity, today’s buyers don’t just seek space, rather, something else. Value, as once defined, no longer beckons by itself; experience, distinctness, and purpose are what it is all about. For investors, accepting these shifting preferences offers not just safety but a chance to shape the destiny of one of the most seasoned industries in the world. Those who adopt this change will redo the criteria for pricing luxury. For inquiries, collaborations, or advice, contact us at Multiowner.