How to Buy Commercial Property and Build Wealth Fast

Introduction

If so, learning how to buy commercial property might be your smartest move yet. Whether you’re dreaming of owning a bustling office space, a retail store, or your first income-generating building, stepping into commercial real estate can feel both exciting and overwhelming. The good news? It doesn’t have to be complicated. In this blog, you’ll uncover the key steps to confidently buy commercial property and set yourself up to build wealth faster than you might think. Ready to explore how smart investors make it happen? Let’s dive in.

How to Buy Commercial Property: Step-by-Step Guide

Considering a move into commercial real estate? You’re not alone. Many investors are turning to commercial property investment as a powerful way to grow wealth, earn passive income, and diversify their portfolio. But to succeed, you need to know the right steps.

In this guide, we’ll walk you through how to buy commercial property, breaking it down into simple, actionable steps that make the process less intimidating and much more achievable.

Understand the Types of Commercial Properties

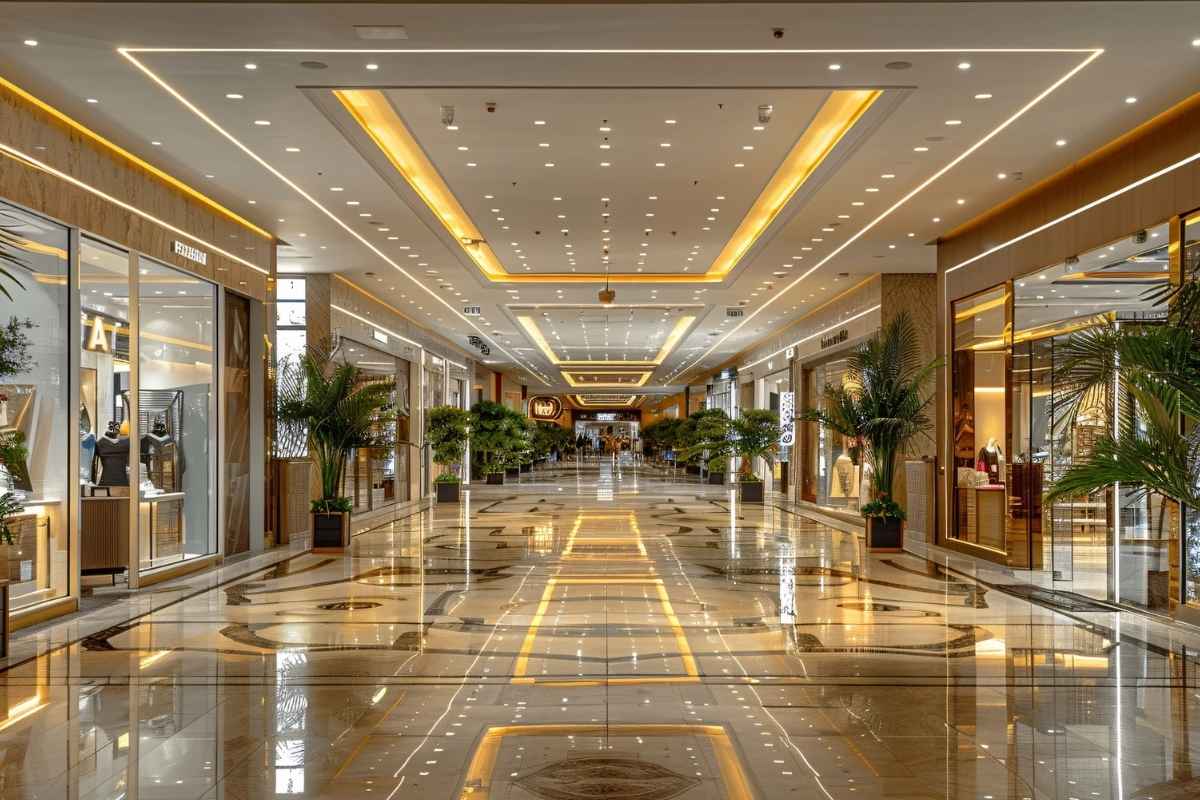

Before anything else, know what you’re getting into. Commercial properties come in several forms:

- Office buildings

- Retail spaces (malls, shops, showrooms)

- Industrial properties (warehouses, factories)

- Multi-family residential units (apartment complexes with 5+ units)

- Mixed-use properties

Each type has its own risk, return, and management level. Pick the one that fits your budget and feels right for you.

Define Your Investment Goals and Budget

Next, get clear on what you want from your commercial property investment. Are you looking for long-term appreciation or monthly rental income? Do you plan to manage it yourself or hire a professional?

Also, establish a realistic budget. Consider:

- Down payment (usually 20–30%)

- Financing limits

- Operating costs and repairs

- Emergency reserves

Knowing your numbers keeps you from overcommitting and helps filter the right properties.

Research the Market Thoroughly

Location is everything in real estate, and even more so in commercial property. Take time to:

- Analyse local economic trends.

- Look for high-demand areas with business growth.

- Check rental rates, occupancy levels, and competition.

- Understand zoning laws and future developments.

A good location not only attracts tenants but also increases your property’s long-term value.

Assemble Your Investment Team

How to buy commercial property successfully? Don’t go it alone. Surround yourself with the right experts:

- Commercial real estate agent – helps you find and negotiate properties.

- Mortgage broker – finds the best financing options.

- Real estate attorney – reviews contracts and legal risks.

- Accountant – advises on taxes, cash flow, and ROI

- Property inspector – uncovers hidden issues.

A solid team helps you avoid costly mistakes and ensures a smoother buying process.

Secure Financing Options

Getting a loan for commercial property investment is a bit different from residential real estate. Banks look at both your personal credit and the property’s income potential.

Some common financing options include:

- Traditional commercial loans

- SBA 504 or 7(a) loans

- Private lenders or investors

- Real estate syndication or partnerships

Be sure to compare interest rates, terms, and fees before deciding.

Evaluate Properties and Conduct Due Diligence

Now that you’re ready to shop, don’t just fall for pretty buildings. Evaluate each property like an investor:

- Check Net Operating Income (NOI)

- Review existing leases and tenant stability.

- Analyse maintenance history

- Consider future value-add opportunities.

- Perform inspections and title searches.

Due diligence protects you from unexpected issues and helps ensure you’re making a wise investment.

Make an Offer and Close the Deal

Once you find the right property, it’s time to act.

- Team up with your agent to put in a strong offer.

- Be ready to negotiate terms and contingencies.

- Finalise financing and complete inspections.

- Sign contracts and handle closing paperwork.

After closing, celebrate, you’re now a commercial property owner!

Why Commercial Property Investment Is a Powerful Wealth Builder

If you’ve ever wondered how successful investors build long-term wealth, there’s a good chance commercial property investment plays a big role. While residential real estate gets a lot of attention, it’s commercial real estate that often delivers stronger cash flow, better returns, and lasting financial growth.

Whether you’re just starting to explore how to buy commercial property or you’re looking to expand your portfolio, understanding the power behind this type of investment can be a game-changer. Let’s dive into the key reasons why commercial property is such a strong wealth-building tool.

Higher Income Potential

One of the biggest advantages of commercial property investment is the income it generates. Compared to residential rentals, commercial leases usually bring in significantly more revenue.

Why is the income better?

- Longer lease terms (typically 3–10 years or more)

- Multiple tenants in one property (e.g., a shopping plaza or office building)

- Higher rental rates based on square footage.

- Triple Net Leases, where tenants cover most operating costs

The steady and often predictable income stream makes commercial properties ideal for long-term wealth generation.

Appreciation and Equity Growth

Just like residential property, commercial properties can appreciate over time. But here’s the difference: in commercial real estate, you have more control over that growth.

Looking to boost your property’s value? Try these tips:

- Improving tenant mix

- Upgrading facilities or interiors

- Increasing rent through renovations or added amenities

- Reducing expenses to raise Net Operating Income (NOI)

As the NOI increases, so does the property’s market value. This strategy is essential when learning how to buy commercial property with long-term growth in mind.

Diversification and Risk Management

Smart investors know that putting all your money in one place is risky. Commercial property investment offers a great way to diversify your portfolio.

You can spread risk by:

- Investing in different types of properties (office, retail, industrial)

- Choosing properties in different geographic locations

- Leasing to various tenants across industries

Diversification reduces the impact of market shifts and gives you more stability over time.

Strong Tax Benefits

Owning commercial real estate comes with several tax advantages that can help boost your returns and reduce your liabilities.

Common tax benefits include:

- Depreciation: Write off the value of the building over time

- Mortgage interest deductions

- 1031 Exchange: Defer capital gains taxes by reinvesting profits into another property

These tax incentives can significantly improve your bottom line, one of the lesser-known perks when you’re figuring out how to buy commercial property wisely.

Long-Term Stability and Predictability

Unlike residential leases, which often renew every 12 months, commercial leases tend to last several years. This means:

- Fewer tenant turnovers

- Consistent cash flow

- Clear rental terms outlined in advance

- Less hands-on management in many cases

This long-term predictability makes commercial property ideal for investors seeking passive income and reliable returns.

Leverage and Scaling Opportunities

With the right financing, you can use leverage to buy more property and grow your portfolio faster. Many commercial investors start with one building, then use the equity and income from that to acquire additional properties.

This compounding effect accelerates wealth-building in a way that’s harder to achieve in other asset classes.

Top Mistakes to Avoid When Buying Commercial Property

Learning how to buy commercial property can be exciting, but it’s also a big financial step that comes with its own set of risks. Many first-time (and even experienced) investors fall into common traps that can turn a promising deal into a money drain.

Whether you’re just starting with commercial property investment or looking to avoid costly errors on your next deal, understanding these common mistakes can save you time, stress, and serious money.

Here are the top mistakes to avoid when buying commercial property, and how to steer clear of them.

Skipping Proper Market Research

One of the biggest mistakes investors make is jumping into a deal without understanding the local market. Location is everything in real estate, and this is especially true in commercial.

Avoid this by:

- Researching demand for commercial spaces in the area

- Understanding local business trends and economic conditions

- Reviewing comparable lease rates and occupancy levels

Without proper research, your investment could sit empty or underperform.

Failing to Define Clear Investment Goals

Before you even start looking for properties, you need to know why you’re investing.

Are you focused on:

- Cash flow from rental income?

- Long-term property appreciation?

- A quick value-add flip?

Not having clear goals can lead to poor decision-making and mismatched properties. When learning how to buy commercial property, always start with a strategy.

Underestimating the Costs Involved

Commercial property comes with more expenses than residential real estate. Many new investors only account for the purchase price and loan payments, and forget about everything else.

Common overlooked costs include:

- Maintenance and repairs

- Property management fees

- Insurance and taxes

- Vacancy periods

- Legal and compliance expenses

A realistic budget is crucial for smart commercial property investment.

Not Doing Thorough Due Diligence

Due diligence is where you separate great investments from potential disasters. Skipping or rushing this step can lead to major surprises down the line.

Make sure to:

- Inspect the physical condition of the property.

- Review current leases and tenant payment history.

- Verify zoning, permits, and legal compliance.

- Analyse the Net Operating Income (NOI) and expenses.

Never skip this step, it protects your investment and helps you make informed decisions.

Choosing the Wrong Property Type

There are many types of commercial properties, offices, retail, industrial, mixed-use, and multi-family. Each comes with different management needs, risks, and return potential.

Mistakes happen when:

- You choose a property that doesn’t match your goals.

- You invest in a sector you don’t understand

- You take on more complexity than you’re ready for

Take time to match your skill level and strategy with the right type of property.

Overleveraging with Financing

While loans can help you grow your portfolio faster, taking on too much debt is a risky move, especially if your property underperforms.

Avoid overleveraging by:

- Keeping your loan-to-value (LTV) ratio conservative

- Ensuring the property’s income can easily cover debt payments

- Having a financial cushion for unexpected costs

A smart commercial property investment balances leverage with long-term stability.

Trying to Do Everything Alone

Commercial real estate is complex, and going solo can be overwhelming and risky. Surrounding yourself with experienced professionals can make all the difference.

Consider building a team that includes:

- A commercial real estate broker

- A real estate attorney

- A commercial loan specialist

- An accountant

- A property inspector

Even seasoned investors know that success in how to buy commercial property often comes from working with the right people.

Tips to Build Wealth Fast with Commercial Property Investment

If you’re serious about growing your wealth, it’s time to consider commercial property investment. While residential real estate can bring in steady income, commercial properties often offer higher returns, better cash flow, and long-term financial growth.

But to truly build wealth fast, you need more than just a basic understanding of how to buy commercial property, you need a strategy. In this post, we’ll walk through practical, proven tips to help you accelerate your success in the commercial real estate world.

Focus on Value-Add Opportunities

One of the fastest ways to grow your wealth in commercial real estate is by investing in value-add properties, buildings that have potential but need improvements.

These may include:

- Outdated office or retail spaces

- Underperforming buildings with low rents

- Properties with high vacancies

By upgrading the property, improving management, or repositioning it in the market, you can significantly increase rental income and property value. This boosts your equity and opens doors for refinancing or profitable resale.

Buy in High-Growth Locations

Location is critical in commercial property investment, but it’s not just about current popularity. Look for emerging areas with signs of growth.

Watch for:

- New infrastructure or transit development

- Population growth

- Business expansion zones

- Upcoming zoning changes

Buying early in these areas can lead to significant appreciation, helping you build wealth faster than in already-saturated markets.

Understand Lease Structures and Tenant Types

Commercial leases can be more complex than residential ones, but they also provide more income stability and fewer management headaches.

Key tips:

- Triple Net (NNN) leases pass most expenses (taxes, insurance, maintenance) to the tenant. This means more predictable income for you.

- Long-term tenants like national franchises or medical offices offer lower turnover and stable cash flow.

When learning how to buy commercial property, don’t just look at the building, study the lease agreements and tenant quality, too.

Reinvest Your Profits Wisely

One of the biggest wealth-building secrets? Don’t sit on your profits, reinvest them.

Smart strategies include:

- 1031 Exchange: Defer capital gains taxes by rolling profits into a new commercial property.

- Use cash flow from one property as a down payment on the next.

- Refinance to pull out equity and fund additional investments.

This “snowball effect” allows you to grow your portfolio and your net worth more quickly.

Use Leverage, but Don’t Overdo It

Leverage (using borrowed money to buy property) is a powerful wealth-building tool. It allows you to control more assets with less upfront capital.

But it has to be used wisely.

Tips:

- Keep a healthy loan-to-value (LTV) ratio.

- Ensure the property’s income easily covers debt payments.

- Have a cash buffer for vacancies or repairs.

Leverage can amplify your returns, but overleveraging can wipe them out.

Keep Learning and Build the Right Team

The most successful investors are always learning. Whether it’s market trends, financing strategies, or better property management techniques, staying educated pays off.

And don’t try to do it all alone. Your success in commercial property investment depends on having a strong support team, including:

- A commercial real estate broker

- Mortgage specialist

- Property manager

- Real estate attorney

- Accountant or financial advisor

Their expertise can help you avoid mistakes and spot hidden opportunities.

Conclusion

Building wealth through commercial property investment isn’t just possible, it’s proven. By learning how to buy commercial property the smart way, avoiding common mistakes, and applying strategies like value-add investing, reinvesting profits, and working with a solid team, you can accelerate your financial success. Remember, the key is to stay informed, act strategically, and think long-term. Whether you’re a beginner or growing your portfolio, every smart move brings you closer to financial freedom.

Need a hand getting started or some expert tips along the way? Contact us today to get personalised support on your commercial real estate goals.

Frequently Asked Questions

Q1. What is the first step in learning how to buy commercial property?

Ans. The first step is defining your investment goals and budget. Knowing whether you’re aiming for cash flow, appreciation, or both will guide your property search and financing strategy.

Q2. Why is commercial property investment considered better than residential?

Ans. Commercial properties often offer higher rental income, longer lease terms, and better scalability. They also come with tax advantages and more wealth-building potential.

Q3. What are the most common mistakes to avoid when buying commercial property?

Ans. Common mistakes include skipping due diligence, underestimating costs, choosing the wrong property type, and overleveraging. Proper planning and expert advice help avoid these pitfalls.

Q4. How can I build wealth faster with commercial property investment?

Ans. Focus on value-add properties, reinvest profits, buy in growing areas, and use smart financing. Building the right team and staying educated will accelerate your success.